Robert Hughes

The Consumer Confidence Index from The Conference Board rose slightly in March and remains at a moderately favorable level overall. The composite index increased 1.5 points or 1.4 percent to 107.2 (see first chart). From a year ago, the index is down 6.7 percent. The small change for the month hides much larger changes in the two major components.

The expectations component sank 4.2 points, taking it to 76.6 while the present-situation component increased 10.0 points to 153.0 (see first chart). The expectations index is at its lowest level since February 2014 and only about 6 points above the 2001 recession lows.

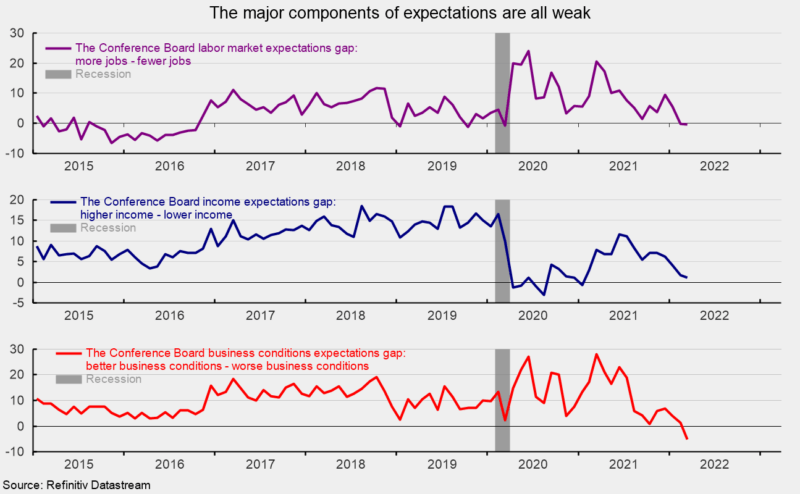

Within the expectations index, all three components fell versus February. The outlook for the jobs market weakened in March as the expectations for more jobs index fell 2.0 points to 17.4 while the expectations for fewer jobs index fell by 1.9 points to 17.7, putting the net down 0.1 points to -0.3 (see top of second chart).

The index for expectations for higher income rose 0.2 points to 14.9 while the index for expectations for lower income rose 0.7 points, leaving the net (expected higher income – expected lower income) down 0.5 points to 1.2 (see middle of second chart).

The index for expectations for better business conditions fell 2.6 points to 18.7 while the index for expected worse conditions rose 3.9 points, leaving the net (expected business conditions better – expected business conditions worse) down 6.5 points to -5.1 (see bottom of third chart).

For the present situation index components, current business conditions and employment conditions improved. The net reading for current business conditions (current business conditions good – current business conditions bad) was -2.5 in March, up from -7.5 but still a net negative. Current views for the labor market saw the jobs hard to get index decrease, falling 2.2 points to 9.8 as the jobs plentiful index rose 3.7 points to 57.2 resulting in a 5.9-point gain in the net to 47.4. A net above 40 is considered strong by historical comparison.

Inflation expectations rose to 7.9 percent in March, a record high; expectations were 4.4 percent in January 2020. Inflation expectations remain extremely high as prices for many goods and services continue to rise at an elevated pace. The extreme outlook for inflation is a key driver of weaker expectations among consumers. The surge in prices for many consumer goods and services is largely a function of shortages of materials, a tight labor market, and logistical issues that prevent supply from meeting demand, though there has been some progress boosting production. Price pressures have been compounded by surging energy prices as a result of the Russian invasion of Ukraine. Furthermore, the newly initiated Fed tightening cycle raises the risk of a policy mistake and adds to the extreme level of risk and uncertainty to the overall economic outlook.

Courtesy: (AIER)