Robert Hughes

New orders for durable goods decreased in December, falling 0.9 percent following a strong 3.2 percent gain in November. Total durable-goods orders are still up 16.0 percent from a year ago. The December drop puts the level of total durable-goods orders at $267.6 billion, a very strong result (see top of first chart).

New orders for nondefense capital goods excluding aircraft or core capital goods, a proxy for business equipment investment, were essentially unchanged in December after gaining 0.3 percent in November and 0.8 percent in October. The results put the level at $79.1 billion, a record high (see bottom of first chart).

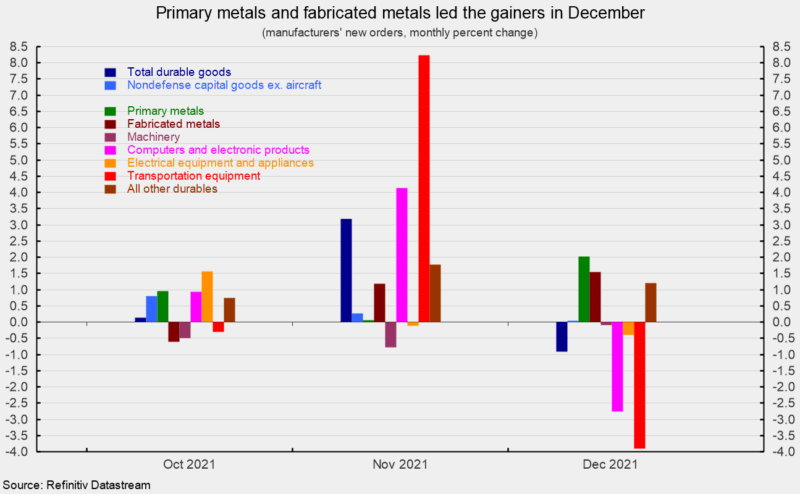

Among the categories in the report, decliners outnumbered gainers four to three. Among the individual categories, primary metals rose 2.0 percent, fabricated metal products gained 1.5 percent, and the catch-all “other durables” category rose 1.2 percent while machinery orders decreased by 0.1 percent, electrical equipment and appliances dropped 0.4 percent, computers and electronic products fell 2.8 percent, and transportation equipment sank 3.9 percent (see second chart). Within the transportation equipment category, motor vehicles and parts increased 1.4 percent as auto manufacturers try to rebound from ongoing chip shortages, but the gain was more than offset by nondefense aircraft which lost 14.4 percent, and defense aircraft which sank 11.2 percent. From a year ago, every major category shows a gain.

Durable-goods orders continue to be strong, particularly the core-capital goods components. Demand remains robust for the manufacturing sector, and the tight labor market creates incentives to substitute capital for labor. The pandemic may be accelerating structural changes to the economy, affecting labor, housing, manufacturing, and services.

The outlook is for continued growth; however, sustained upward pressure on prices continues as demand outpaces supply. As a result, the Federal Reserve is moving to hike interest rates, likely starting in March, and is planning on taking actions to reduce its holding of fixed income securities. These measures should lead to higher short-term and long-term interest rates, thereby reducing demand and eventually loosening the labor market, all of which should ease upward pressure on prices.

However, history suggests that the risk of policy mistakes rises during Fed tightening cycles. Additionally, 2022 is a Congressional election year. Intensely bitter partisanship and a deeply divided populace could lead to turmoil later in the year as confidence in election results are coming under constant attack. Contested results around the country could easily lead to government paralysis, testing the durability of democracy and the union itself.

Courtesy: (AIER)