Robert Hughes

US nonfarm payrolls added 431,000 jobs in March, extending a run of 11 consecutive months and 14 of the last 15 months with gains above 400,000. The average monthly gain over the last 15 months is 562,000 (see first chart).

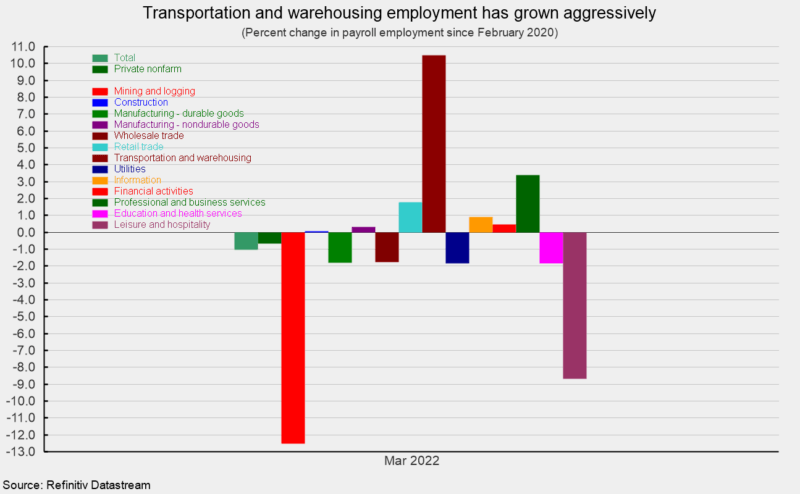

Private payrolls posted a 426,000 gain in March, the 10th in a row and 13th in the last 15 months above 400,000 (see first chart). The average gain over the last 15 months is 530,000. Both total nonfarm payrolls and private payrolls are less than 1 percent below their February 2020 peaks with total nonfarm down by 1.6 million and private payrolls down by less than 1 million (see second chart).

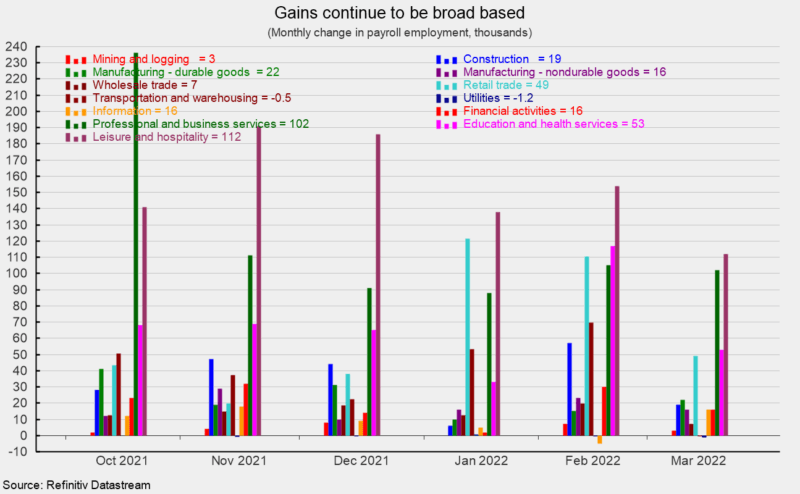

Gains in recent months have been broad-based. Within the 426,000 gain in private payrolls, private services added 366,000 versus a 12-month average of 460,500 while goods-producing industries added 60,000 versus a 12-month average of 54,800.

Within private service-producing industries, leisure and hospitality added 112,000 versus a 12-month average of 173,800 for the month, business and professional services added 102,000 (versus 91,300), education and health services increased by 53,000 (versus 50,100), retail employment rose by 49,000 (versus 45,600), and wholesale trade gained 7,000 (versus 12,800); transportation and warehousing lost 500 jobs (versus an average gain of 33,900; see third chart).

Within the 60,000 gain in goods-producing industries, construction added 19,000, while durable-goods manufacturing increased by 22,000 and nondurable-goods manufacturing added 16,000 and mining and logging industries increased by 3,000 (see third chart).

Despite the strong, broad-based gains over the past year, only about half of the industry groups in the employment report are above their pre-pandemic levels. Transportation and warehousing is the largest gainer, with payrolls more than 10 percent above pre-pandemic levels (see fourth chart). That may be a positive sign for some of the logistical problems plaguing U.S. businesses.

Average hourly earnings rose 0.4 percent in March, putting the 12-month gain at 5.6 percent. The average hourly earnings for production and nonsupervisory workers also rose 0.4 percent for the month and are up 6.7 percent from a year ago. The average hourly earnings data should be interpreted carefully, as the concentration of job losses and recovery for lower-paying jobs during the pandemic distorts the aggregate number. The average workweek for all workers fell to 34.6 hours in March while the average workweek for production and nonsupervisory workers fell 0.1 hour to 34.1 hours. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls for all workers gained 0.5 percent in March and is up 10.80 percent from a year ago; the index for production and nonsupervisory workers also rose 0.5 percent but is 11.5 percent above the year ago level.

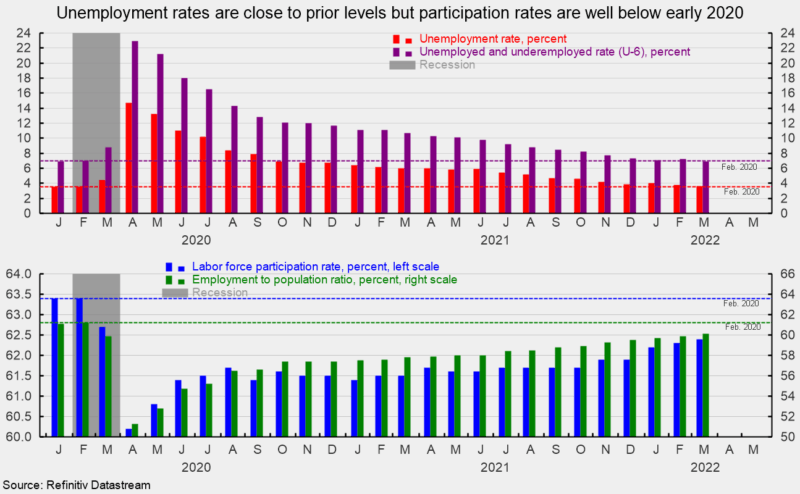

The total number of officially unemployed was 5.952 million in March. The unemployment rate came in at 3.6 percent while the underemployed rate, referred to as the U-6 rate, was 7.2 percent in March. In March 2020, the unemployment rate was 3.5 percent while the underemployment rate was 6.9 percent (see top of fifth chart). For February 2020, the unemployment rate was 3.5 percent while the U-6 rate was 7.0 percent.

The employment-to-population ratio, one of AIER’s Roughly Coincident indicators, came in at 60.1 percent for March, still significantly below the 61.2 percent in February 2020 (see bottom of fifth chart).

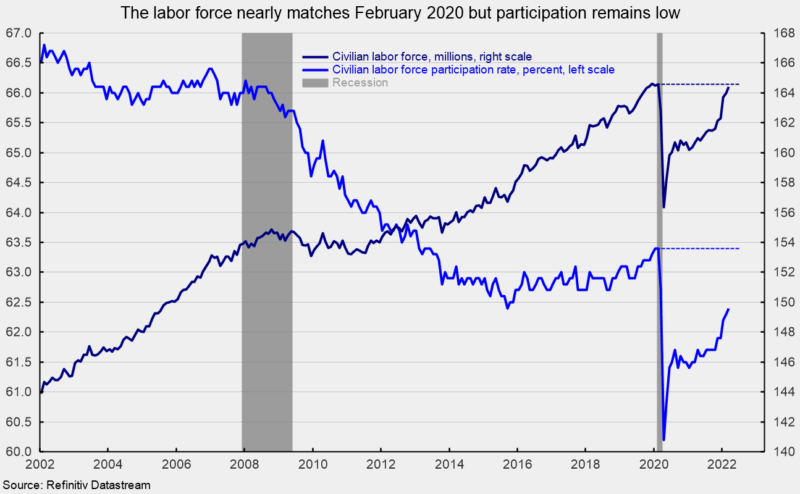

It has taken two years, but the labor force is nearly back to the size in February 2020 (see sixth chart). However, with population growth over that time, the overall participation rate remains well below February 2020. The participation rate was 62.4 in March 2022 versus a participation rate of 63.4 percent in February 2020 (see bottom of fifth and sixth charts).

The March jobs report shows total nonfarm and private payrolls posted more strong gains. Both are close to matching pre-pandemic levels as is the civilian labor force. However, with population growth, labor force participation remains significantly below pre-pandemic rates. Getting people into the labor force and employed would likely help ease upward pressure on consumer prices. Upward price pressures have resulted in a new cycle of Fed policy tightening, raising the risk of a policy mistake. Furthermore, geopolitical turmoil surrounding the Russian invasion of Ukraine has had a dramatic impact on capital and commodity markets, launching a new wave of potential disruptions to businesses. The outlook has become highly uncertain and extreme caution is warranted.

Courtesy: (AIER)