PARIS (AFP): French President Emmanuel Macron told global leaders Thursday that no country should have to choose between tackling poverty and dealing with climate change at a summit tasked with reimagining the world’s financial system.

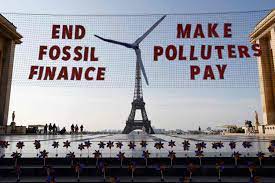

The Summit for a New Global Financial Pact is aimed at finding the financial solutions to the interlinked global goals of tackling poverty, curbing planet-heating emissions and protecting nature.

In his opening remarks Macron told delegates that the world needs a “public finance shock” — a global push of innovation and financing — to fight these challenges, adding the current system was not well suited to address the world’s challenges.

“Policymakers and countries shouldn’t ever have to choose between reducing poverty and protecting the planet,” Macron said.

Ugandan climate campaigner Vanessa Nakate took the podium after Macron and asked the audience, which included oil-rich Saudi Arabia’s Crown Prince Mohammed bin Salman, to take a minute of silence for people who are suffering from disasters.

She slammed the fossil fuel industry, saying they promise development for poor communities but the energy goes elsewhere and the profits “lie in the pockets of those who are already extremely rich”.

“It seems there is plenty of money, so please do not tell us that we have to accept toxic air and barren fields and poisoned water so that we can have development,” she said.

Economies have been battered by successive crises in recent years, including Covid-19, Russia’s invasion of Ukraine, spiking inflation, debt, and the spiralling cost of weather disasters intensified by global warming.

Leaders attending the summit include Barbados Prime Minister Mia Mottley, who has become a powerful advocate for reimagining the role of the World Bank and International Monetary Fund in an era of climate crisis.

“What is required of us now is absolute transformation and not reform of our institutions,” said Mottley, whose country has put forward a detailed plan for how to fix the global financial system to help developing countries invest in clean energy and boost resilience to climate impacts.

“We come to Paris to identify the common humanity that we share and the absolute moral imperative to save our planet and to make it livable,” she said.

– Debt or healthcare –

Other participants include UN Secretary-General Antonio Guterres, US Treasury Secretary Janet Yellen, IMF director Kristalina Georgieva and World Bank chief Ajay Banga.

Outlining the challanges facing developing countries, Guterres said more than fifty nations were now in or near debt default — many of which are also particularly vulnerable to climate impacts — while many African countries are now spending more on debt repayments than on healthcare.

Guterres said the global financial system, which was conceived at the end of World War Two, was failing to rise to modern challenges and now “perpetuates and even worsens inequalities”.

“We can take steps right now and take a giant leap towards global justice,” he said, adding that he has proposed stimulus of $500 billion a year for investments in sustainable development and climate action.

Observers are looking for tangible progress from the summit — including on promises already made, including an update on a 2009 pledge to deliver $100 billion a year in climate finance to poorer nations by 2020, not yet fulfilled.

A second pledge to rechannel $100 billion in unused “special drawing rights” (SDRs) — the IMF’s tool to boost liquidity — will also be in the spotlight.

– Big ideas –

Yellen said the United States would use the summit to push for creditors to grant relief and restructure debts of developing countries.

China, a major global creditor, has come under scrutiny for its lack of participation in multilateral efforts to ease the debt burden on developing countries.

The summit comes amid growing recognition of the scale of the financial challenges ahead.

Last year, a UN expert group said developing and emerging economies excluding China would need to spend around $2.4 trillion a year on climate and development by 2030.

Countries are calling for multilateral development banks to help unlock climate investments and significantly increase lending, while stressing that new debt arrangements should include, as Barbados has, disaster clauses allowing a country to pause repayments for two years after an extreme weather event.

Other ideas on the table include taxation on fossil fuel profits and financial transactions to raise climate funds.

The French presidency is backing the idea of an international tax on carbon emissions from shipping, with hopes of a breakthrough at a meeting of the International Maritime Organization in July.

Observers are also keenly awaiting details of a plan from South American countries to create a global structure for so-called debt-for-nature swaps.