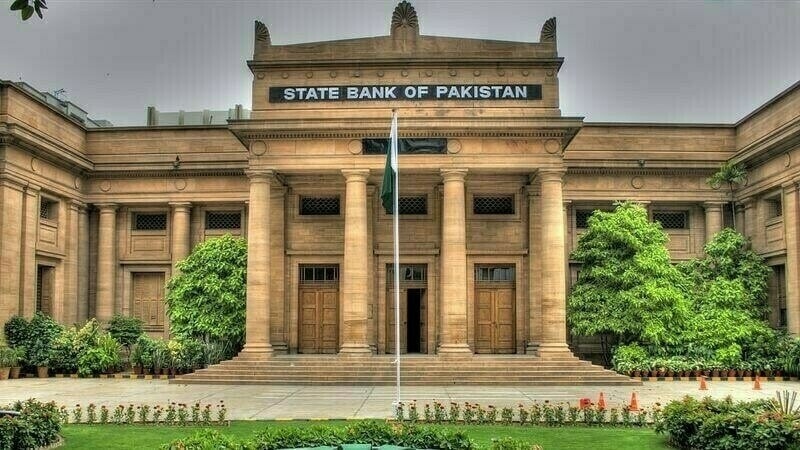

The State Bank of Pakistan’s Monetary Policy Committee (MPC) has announced to maintain the policy rate at 22 percent. According to the committee, headline inflation rose in September 2023 (31.4%), while the key policy rate projected to decline in October and likely to maintain a downward trajectory in the second half of the current fiscal year.

Pakistan’s economic outlook remained highly volatile in the consecutive second year through 2021 and 2022. The public faced serious repercussions of continued political instability together with the worst effects of the war in Ukraine and global energy crisis throughout the past months. Pakistan’s failure in economic micromanagement, lax control over the domestic market, market exploitation of business cartels and exchange market manipulation of private banks made this fiasco uncontrollable and unbearable for the government and the masses respectively. There had been significant improvement in economic indicators after the PDM government signed a $ 3 billion standby program with the IMF but that also had nominal effects on the currency market and inflation.

Realistically, real improvement and sustainability has been observed in Country’s economic condition, currency market and skyrocketing inflation after the interim government initiated a military back campaign against the mafias and announced strict measures against violators including deportation of illegal migrants from the country. The inflation rate came down significantly in October due to downward movement in fuel prices, easing prices of some major food commodities, and a favourable base effect. Meanwhile, the domestic economic indicators project a continuous decline in headline inflation in the coming months if no external factor such as the Hamas Israel conflict does not affect the global oil market in the future.

As a matter of fact, the central bank failed to implement a strict regime for the private banks that got involved in currency manipulation, opening of benami accounts, and facilitation of fraud business schemes, which has caused billions of rupee loss to the masses. Similarly the State Bank failed to ensure global standard credit services in the country as a majority of Pakistani banks neither maintain customer credit score nor offer them rewards, which is a serious drawback of our banking sector. There is a lot of room for improvement in our banking system and macroeconomics in the country, however the baboos have no spare time for nation building and public service.