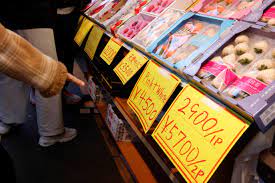

TOKYO (Reuters): Japan’s real wages slipped in September for an 18th month, while consumer spending extended a months-long decline, with rising prices squeezing households’ purchasing power, and likely to add to pressure from labour groups for higher wage increases.

Financial markets worldwide pay close attention to the wage trends in the world’s third-largest economy. The Bank of Japan regards sustainable pay increases as one of the prerequisites for unwinding its ultra-loose monetary stimulus.

Inflation-adjusted real wages, a barometer of consumer purchasing power, dropped in September by 2.4 per cent from a year earlier after a revised 2.8pc fall the month before, data from the Ministry of Health, Labour and Welfare showed.

The consumer inflation rate officials use to calculate real wages, which includes fresh food prices but excludes owners’ equivalent rent, slowed to 3.6pc, the lowest since September last year.

Still, nominal pay growth in September was 1.2pc, after a downward revision of 0.8pc in August and only slightly better than in July.

Major companies agreed to average pay hikes of 3.58pc this year, the highest increase in 30 years. Average Japanese workers’ wages had remained virtually flat since the asset-bubble burst in the early 1990s until this year.

Japan’s largest labour organisation Rengo is expected to demand pay increases of 5pc or more, while the largest industrial union, UA Zensen, will seek a 6pc wage increase in negotiations early next year.

Some economists, however, are not optimistic about the prospect of a recovery in consumption.

“The increase in nominal wages from this year’s spring labour negotiations are usually reflected by the end of August, so there is no reason for that to go up from that point,” said Shunsuke Kobayashi, chief economist at Mizuho Securities.

Also, even if higher wages are negotiated for next year, there is a risk of inflation re-accelerating if the government did not extend the current fuel and power subsidies, Kobayashi said.

Prime Minister Fumio Kishida’s government last week drew up a 17 trillion yen ($113.72 billion) economic stimulus package that includes slashing annual income tax and other taxes by 40,000 yen ($267.58) per person and paying 70,000 yen to low-income households.

Special payments fell 6pc year-on-year in September after a revised 6.3pc decline in August. The indicator tends to be volatile in months outside the twice-a-year bonus seasons of November and January and June to August.

Base salary growth in September advanced by 1.4pc year-on-year, from a revised 1.2pc increase the previous month, the data showed.

Overtime pay, a gauge of business activity, went up in September by 0.7pc year-on-year, after a revised 0.2pc gain in August.

SLUGGISH SPENDING

Household spending decreased 2.8pc in September from a year earlier, falling for seven months in a row, separate data on Tuesday showed. It was roughly in line with the median market forecast for a 2.7pc decline.

On a seasonally adjusted, month-on-month basis, household spending climbed 0.3pc, versus an estimated 0.4pc fall.

Expenses in eating out, transportation and automobile-related spending went up due to an increase in outings, while spending on food, housing, furniture and household goods decreased partly due to rising prices, a government official said.