BY: Malte Humpert

WASHINGTON DC (GCaptain): A new 10-year report by the Arctic Council’s Working Group on the Protection of the Arctic Marine Environment (PAME) highlights a substantial increase in shipping across the Arctic Ocean.

The number of vessels operating in the Arctic increased almost 40 percent between 2013 and 2023, from 1,298 per year to 1,782. Fishing vessels remain the single largest category of ships, followed by general cargo ships and bulk carriers.

“Several reasons contribute to the increase in Arctic shipping,” said Hjalti Hreinsson, Project Manager at PAME in charge of the report. “One of them, and perhaps the most prominent one, is an increase in natural resource extraction. Compared to other marine areas worldwide, there aren’t that many ships in the Arctic, and new projects will strongly impact statistics.”

The report details traffic from two large resource projects in the Canadian and Russian Arctic.

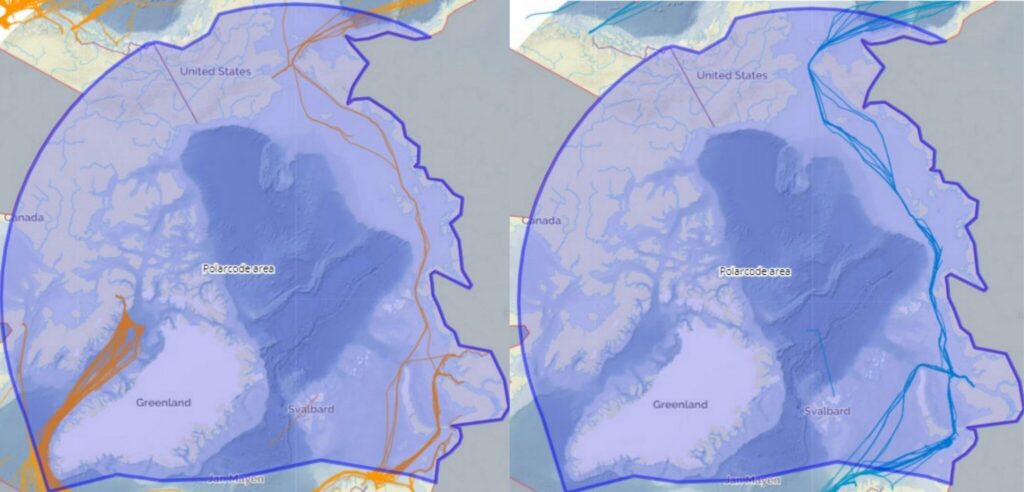

“The Mary River Mine in Nunavut and the Yamal Gas project have led to increases in shipping in the Arctic Polar Code area. The number of bulk carriers has significantly increased as has the traffic of gas tankers, of which there were almost none in the Polar Code area prior to 2018,” explained Hreinsson.

Not only is the Arctic seeing more vessels, but the length of voyages has increased as well. The total distance sailed by all vessels more than doubled over the past decade, from 6.1 million nautical miles to 12.9 million.

Over the study period the Russian Arctic recorded the most significant growth in traffic. The increase is driven by Novatek’s Yamal LNG project, Gazprom’s Arctic Gate and Prirazlomnoye oil projects, and Lukoil’s Varandey oil terminal.

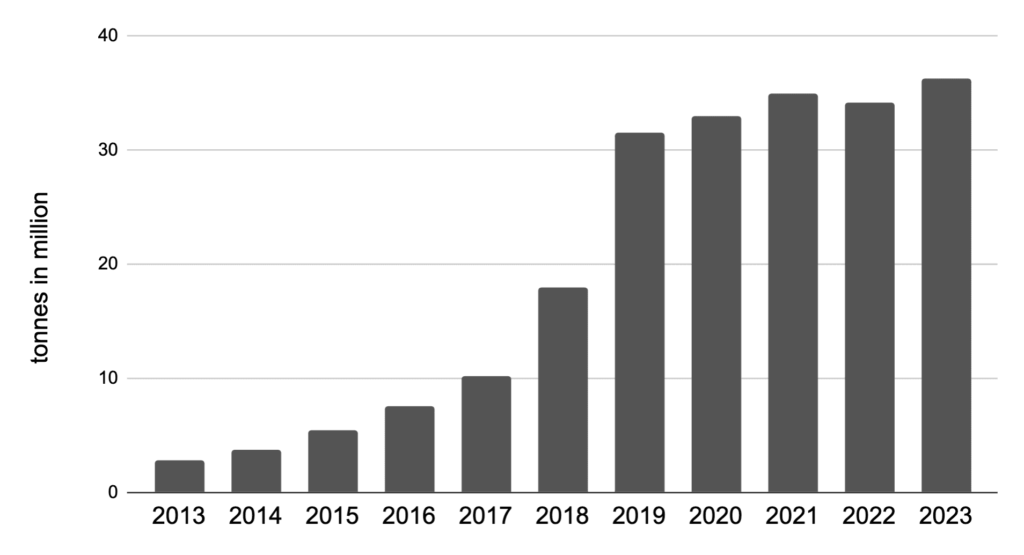

Cargo volumes along Russia’s Northern Sea Route (NSR) have grown 13-fold over the past decade, from just 2.8m tonnes in 2013 to a record 36.3m tonnes last year.

A previous report by PAME on ships per flag state also confirmed Russia’s dominant position in Arctic shipping. In 2022, out of 1,661 ships, 885 flew the Russian flag, followed by Norway and Denmark with 180 and 122 vessels, respectively.

Even with the uncertainty surrounding the future of Novatek’s new Arctic LNG 2 project, tonnage across the Russian Arctic waters is forecasted to expand rapidly. Official Russian figures project volumes on the NSR to reach between 117 million and 244 million tonnes by 2030.

The next major resource development to drive Arctic shipping will be Rosneft’s Vostok oil project, expected to come online in 2024. Depending on the availability of ice-class oil tankers export volumes per year could reach in excess of 100 million tonnes by 2033.

In contrast to Chinese investments in the Russian Arctic overall, its role in Arctic shipping remains limited.

Throughout the past decade less than a hundred Chinese-flagged or -owned vessels have ventured across the Arctic Ocean, primarily general cargo ships.

In 2023 Chinese NewNew Shipping established the first regular container liner service in the region. Using four ice-capable box ships the service connects East Asia and St Petersburg, with limited stops in Arkhangelsk. One of the vessels, NewNew Polar Bear, remains under investigation related to the damage of the Balticonnector pipeline and subsea telecoms cables in the Baltics.

For 2024, the company plans to expand its Arctic service to seven vessels.